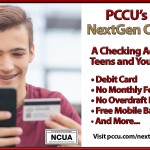

Congratulations, Parents! PCCU’s new NextGen Checking is what you have been looking for when starting a checking account for your teenagers or young adults ages 13-25! Teach your teenagers the responsibility of having their own checking account with our “checkless checking” debit card. This bank account and debit card gives your teen or young adult the freedom of their own checking account while you can maintain how much your kids can spend, where they can…

Summer is the perfect time to take a break! When you’re ready to take a break from work, why not take a break from your loan(s) at PCCU? For a $25 fee per loan you can take a month long break from paying your loan(s). Put some money back in your pocket and make your summer getaway easier on the wallet! Just stop in to a branch or print and fill in this form and…

We appreciate the time many members took to fill out and return the Member Service Survey postcards we sent to thousands of you in February. We were beyond excited to find out that almost 85% of you who responded are PCCU promoters, who have and continue to recommend the credit union to your friends, family, and co-workers. Thank you! Those referrals are how PCCU gets passed on to the next generation. Here are just a…

At PCCU you can do better! Our Ultimate Checking is free when you choose estatements and one of its best features is PCCU AllWays Mobile Banking. The free download on iOS and Android devices puts PCCU in your pocket for 24/7 service with up to the minute balances on your accounts and make transfers between them. But what else makes it great? Take PCCU With You Wherever You Go! Control your debit card by turning off and on…

It’s crucial for your family to know the basics of financial literacy, but how do you approach teaching them? Luckily, you’re making financial decisions every day—you simply need to let your kids in on the conversation. What is Financial Literacy? Financial literacy includes many different financial skills and concepts; to be financially literate simply means having the know-how to make wise decisions with your personal finances—like managing a budget, borrowing money, paying for insurance, and…