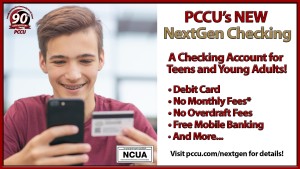

Congratulations, Parents! PCCU’s new NextGen Checking is what you have been looking for when starting a checking account for your teenagers or young adults ages 13-25! Teach your teenagers the responsibility of having their own checking account with our “checkless checking” debit card. This bank account and debit card gives your teen or young adult the freedom of their own checking account while you can maintain how much your kids can spend, where they can spend, and more. Plus…there are no monthly service fees* or overdraft fees!

- Your teen/young adult can use their own debit card to make purchases at stores or online.

- No Monthly Service Fees*

- No Overdraft Fees

- Mobile Wallets through Apple Pay; Samsung Pay; and Google Pay!

- Mobile Bill Pay – Set up automatic payments for monthly bills or send money to parents or friends.

- No Minimum Balance

- Monitor your teens spending, control spending limits, set up spending notifications and more with the PCCU Card Security App.

- Access to more than 5,000 ATMs through Alliance One and more than 25,000 ATMs through MoneyPass. Visit www.allianceone.coop and www.MoneyPass.com to find their closest respective ATMs.

What you need to get started!

Getting started is easy. Just bring the following to one of our branches:

- Two pieces of identification; for example, your driver’s license, Social Security card, birth certificate, school ID, etc. While your social security card itself is not required if it is not one of your two pieces of id, you must be able to provide your Social Security number.

- $25 to open your membership account (Regular Share)

- Your parent or guardian (and two forms of ID for them)

Prospective members under the age of 18 must have an adult joint member on the account.

*No monthly service fees until the primary accountholder turns 25. Once the primary accountholder turns 25, they can change to an Xpress Checking Account, there will be a minimal monthly service fee of $4.95 per month with a $2.00 per month fee for paper statements. You can eliminate the $2 paper statement fee by electing to receive FREE estatements. There is a $10 non-use fee on the debit card if the debit card is not used a minimum of one (1) transaction per month. When the primary account holder turns 18, the adult joint member (parent/guardian) may remove themselves from the account; the primary accountholder may also choose to transition to PCCU’s Ultimate Checking. We encourage members to contact us at this time to determine which approach best suits your teen/young adult.