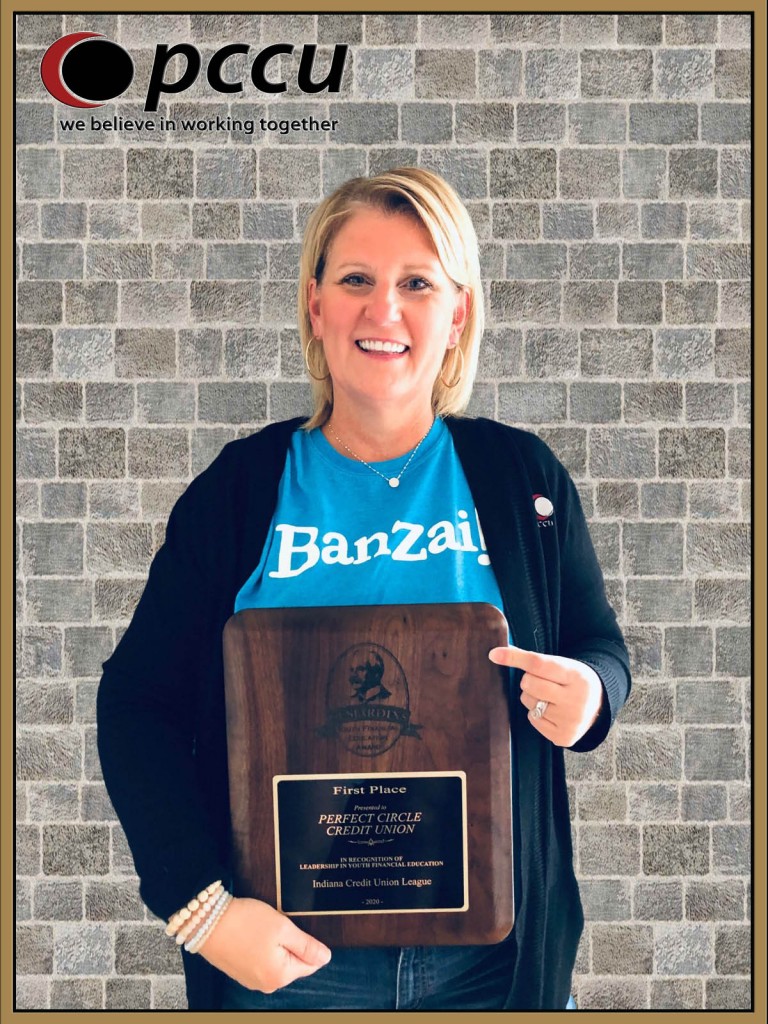

The Indiana Credit Union League’s (ICUL) annual convention in Indianapolis is a chance for credit unions around the state to get together and learn from one another. It was exhilarating this year, despite the virtual format, because PCCU was recognized by the League for promoting financial literacy among local youth with the First Place Alphonse Desjardins Award for Indiana Credit Unions in the $50M to $250M size. The Credit Union National Association (CUNA) created the Desjardins program to recognize leadership within the credit union movement on behalf of financial literacy for all ages. Named after Alphonse Desjardins, who founded the first credit unions in Canada and the U.S. in the early 20th century and pioneered youth savings clubs and in-school “banks”,the award emphasizes the credit union movement’s long-time commitment to financial literacy. Having won the ICUL’s first prize, PCCU goes on to compete with credit unions from across America for CUNA’s national Desjardins Award.

PCCU’s Education and Outreach Director, Kim Welch, was excited about the award because, “…the credit union puts such an emphasis on financial education and community outreach, and it’s nice to have that work recognized publicly for its impact.”. Taking financial education to children is a passion for Welch who finds, “they are interested in the topic and many of them feel as though they aren’t getting the information or experience they need. I see their hunger for financial education and bringing them the information and tools they need to better themselves is rewarding.”.

She focused in on the value of Banzai, which the credit union sponsors and provides to many local schools, teachers, and students at no charge. She said, “Banzai is great because it provides students with simulations that help them understand that financial choices have consequences, good and bad. It lets them make mistakes they can learn from without being haunted by for years like an adult with a bad credit report.”. Kim also noted that if children weren’t getting Banzai in school that parents and/or grandparents could access it freely on PCCU’s website (pccu.com) and get their children and/or grandchildren learning at home.

Kim said the most important thing parents or grandparents could do to help children learn to handle money responsibly was to give them some. Or rather, give them the opportunity to earn some money and then have frank discussions with them about deciding how to use what they’ve earned. She recommended helping children set up three separate jars or piggy banks, one each for spending, saving and giving. Then discuss with them how much of their earnings they plan to devote to saving for future needs and wants, spending on current expenses, as well as developing a habit of giving back to the community in a way of their own choosing. Kim said, “Helping them plan how they will use their money and developing a saving habit early will really give them a running start in life.”.

PCCU is extremely proud of Kim’s efforts on behalf of local students and commend her for her hard work and devotion to her passion. She truly embodies PCCU’s philosophy of “people helping people”, and demonstrates what PCCU and the credit union movement is all about.